Chronograph

for Limited Partners

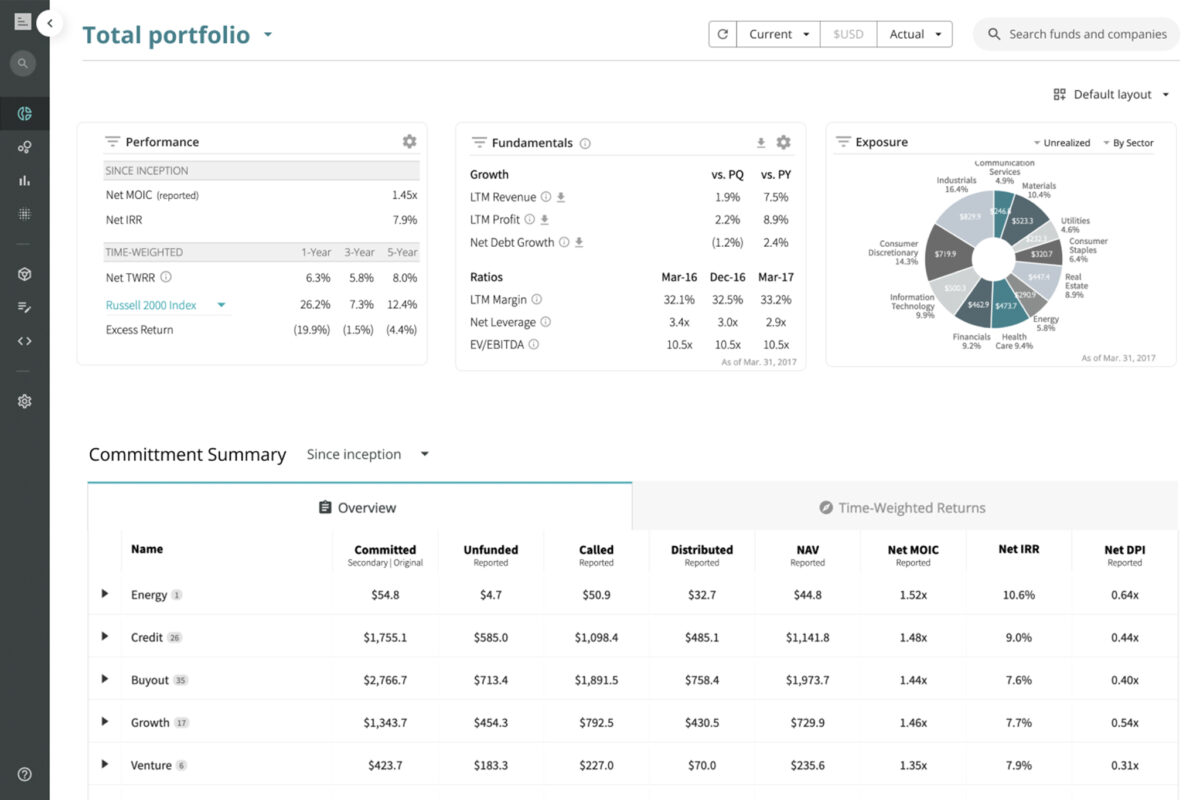

Unify data from fund commitments, secondaries, co-investments, directs, and more to turn scattered PDFs, Excel files, databases and other sources into a complete view of private capital performance and exposure.

Insights, Revealed

Chronograph provides unrivaled insights on underlying fund and portfolio company performance. No clunky templates, no self-reported data, no burdens on GPs, no new work.

Unprecedented Breadth + Depth

Capture all available information about your private capital portfolio to put your returns in context

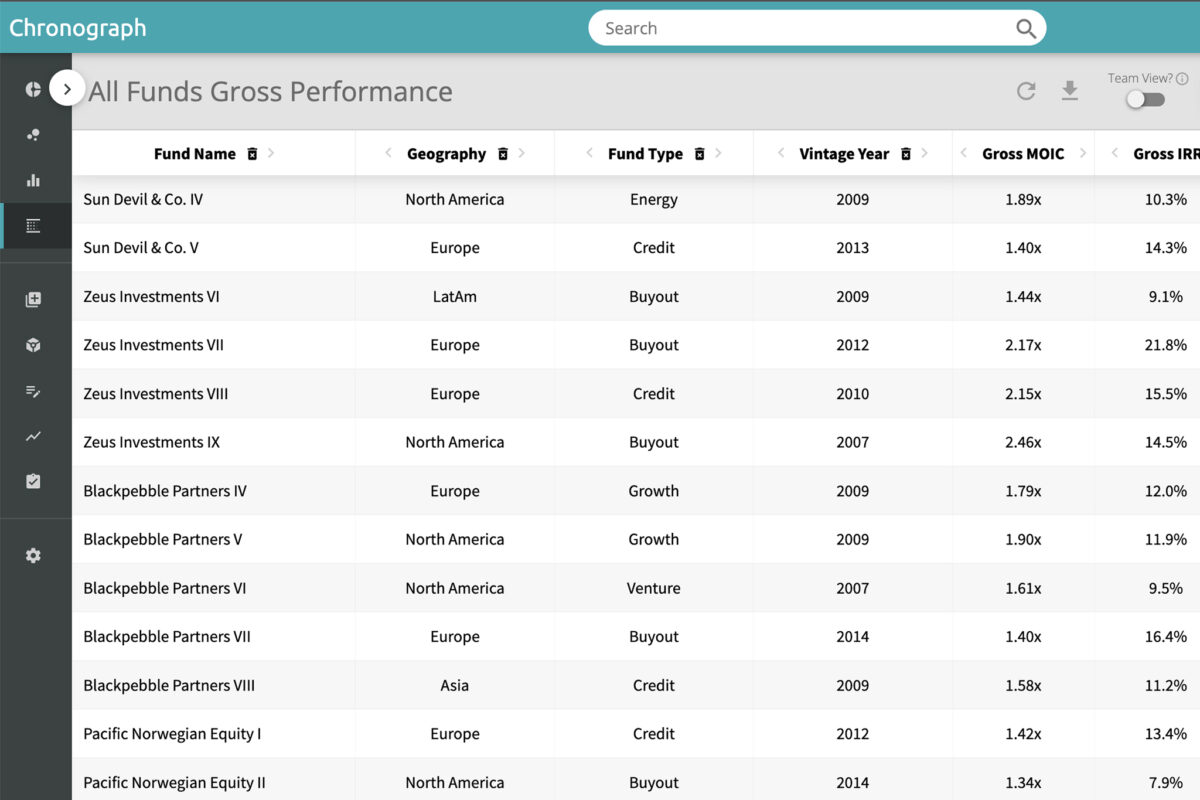

Simplified Reporting

Hassle free, Microsoft compatible

Make internal and external reporting easier with Chronograph’s extensive toolset.

Chronograph integrates with your existing systems to provide investment, reporting, and financial professionals a consolidated interface for interacting with, protecting, and making use of your data.

Create team-sharable templates and raise brand standards easily refreshable information sets to confidently communicate your message to stakeholders.

Power models and reports with our Microsoft Office toolset.

Upgrade existing models with the robust Chronograph xConnect Excel plug-in.

Export charts and underlying data for any graph, table, or other representation from the platform with a single click.

Harness AI capabilities across your entire portfolio

Synthesize and summarize large data sets on demand to quickly gain key insights on fund and company performance, market and industry updates, transaction activities, outlooks for investments, news on management teams, and ESG reporting.

Building on Chronograph’s existing dynamic document tools and data management infrastructure, Chrono AI allows LP clients to interface with the millions of documents they keep on Chronograph, spanning quarterly reports, capital accounts statements, partnership financials, capital calls and distributions, legal notices, formation documents, LPAs, and AGM materials.

API + Connectivity

Engineered for Integration

The days of walled gardens are over – easily integrate existing architecture and data sources upstream and downstream.

Chronograph serves as a private capital ‘macro service’ with interconnectivity at its core.

From modern standards to industry-leading middleware architecture, Chronograph’s APIs are designed for developer ease-of-use and interoperability.

Access data at scale with our GraphQL-based APIs. Chronograph makes it easy to get data out both at runtime and in bulk.

Connect your existing systems and vendors with seamless GUI middleware. Integrate accounting, CRM, and benchmarking solutions to unlock new levels of consolidated analysis.

Approved developers can generate a key and start building immediately with helpful tools like a dynamic schema knowledge-base that’s always up to date.

Snowflake Data Warehousing

Plug-and-play

Chronograph’s Snowflake Connectivity-as-a-Service offering, Snowbank, significantly simplifies data ELT at scale, making it easy to port all client data into a long-term persistence medium.

Implementation is turnkey via Snowflake’s Secure Data Share features. Achieve real-time data replication with no limitations on extraction or access.

Our integrations unlock new forms of aggregate analyses through the Snowflake plug-in suite. Reduce time-to-production for services built on top of data managed in Chronograph.

Realize automated and compatible migrations and updates to models. Eliminate resource-intensive data warehouse integration management.

ESG

Now with Data

Environmental, Social and Governance (ESG) issues are now major considerations for private capital investors. However, many investors feel at a loss how to aggregate and monitor ESG information in their funds and portfolio companies.

Chronograph offers a high integrity, centralized data collection system that empowers private capital investors to properly collect, manage, and report ESG standards.

Access meaningful, performance-based, and comparable ESG data from across your portfolio from a single interface.

Security + Confidentiality

Without Compromise

Rest easy knowing that your sensitive data is protected by industry-leading security standards.

Our policies are client-centric and make it simple: we will never share your private information. We are not a public database, benchmark provider, or consultant.

As a trusted provider to many of the world’s largest private capital investors, Chronograph takes protecting client data, intellectual property, and any personal information extremely seriously – and embraces best practices and leading technology to ensure compliance.

Chronograph’s vendors and operations are SOC I/II and ISO27001 compliant, and we place client security and confidentiality at the heart of everything we do.

Case Study:

Montana Capital Partners + Chronograph

How Chronograph Enables Montana Capital Partners’ Data-Driven Secondaries Program.

Submit the form to receive a copy of the case study.

Start streamlining your portfolio monitoring and diligence

Learn more about how Chronograph can streamline your private capital investment monitoring and diligence